#ESH23 (S&P 500 March 23). Exchange rate and online charts.

Currency converter

23 May 2025 23:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

See Also

- Technical analysis / Video analytics

Forex forecast 23/05/2025: EUR/USD, GBP/USD, SP500, Gold, and Bitcoin

Technical analysis of EUR/USD, GBP/USD, SP500, Gold, and BitcoinAuthor: Sebastian Seliga

10:51 2025-05-23 UTC+2

4603

Donald Trump threatens EU with 50% tariffs on importsAuthor: Marek Petkovich

14:59 2025-05-23 UTC+2

2413

Fundamental analysisMarket Chaos to Continue (There is a likelihood of continued local declines in #USDX and gold prices)

Markets continue to act blindly amid the chaotic actions of Donald Trump, who is trying to pull the U.S. out of a deep, all-encompassing crisis like Baron Munchausen pulling himself out of a swamp by his own hairAuthor: Pati Gani

10:19 2025-05-23 UTC+2

2413

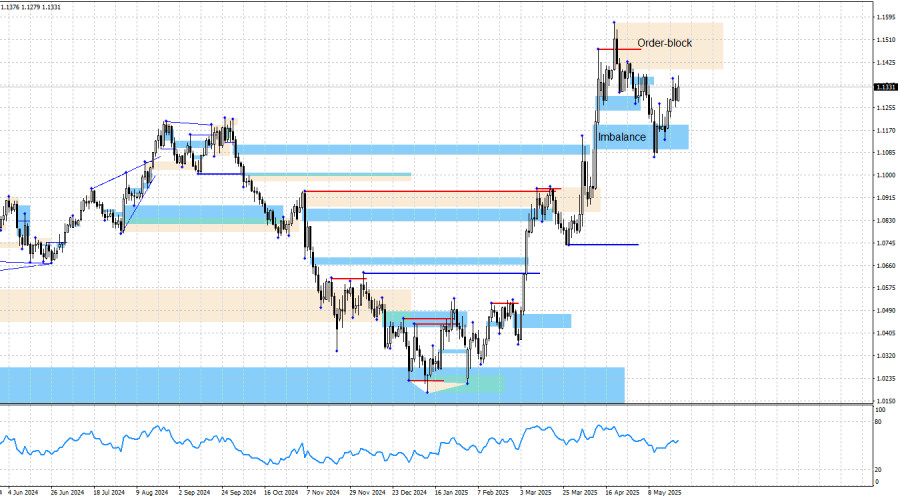

- Bulls launch a new offensive—the target is near

Author: Samir Klishi

20:09 2025-05-23 UTC+2

2338

Technical analysisTrading Signals for BITCOIN for May 23-27, 2025: sell below $108,700 (200 EMA - 21 SMA)

Our trading plan is to sell BTC below 108,700, or if it returns to $111,500, it will be seen as an opportunity to sell.Author: Dimitrios Zappas

18:16 2025-05-23 UTC+2

2278

Technical analysisTrading Signals for GOLD for May 23-27, 2025: sell below $3,360 (7/8 Murray - 21 SMA)

On the other hand, if gold consolidates above 3,370, the outlook could remain positive, and we could expect it to rise and reach 8/8 of the Murray level at 3,437.Author: Dimitrios Zappas

18:14 2025-05-23 UTC+2

2278

- The USD/JPY pair is in a zone of heightened price turbulence. Today's inflation report from Japan has only intensified investor interest in the yen.

Author: Irina Manzenko

13:52 2025-05-23 UTC+2

2263

The precious metal has recovered after last week's sell-off driven by concerns over U.S. fiscal policy.Author: Marek Petkovich

17:31 2025-05-23 UTC+2

2218

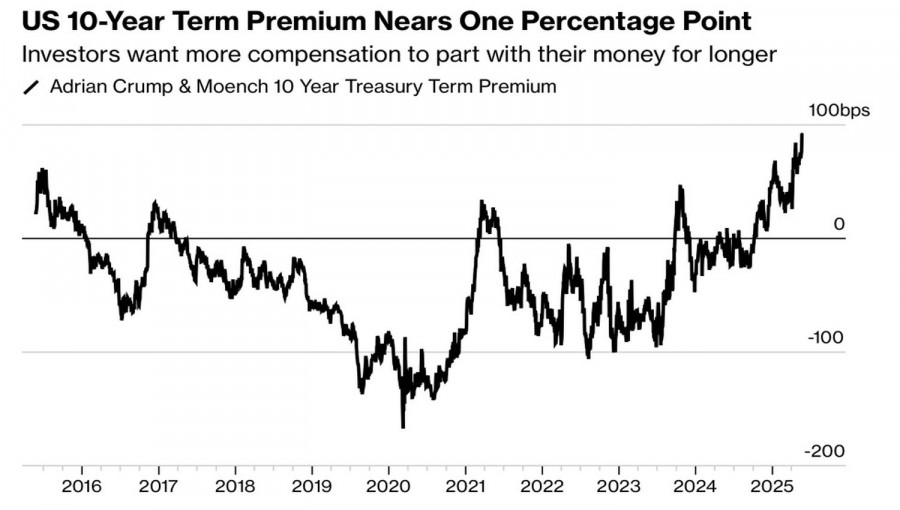

Investors are increasingly sensing cracks in the foundation beneath them. This week's approval of a large-scale fiscal package by the Trump administration with promises of tax cuts and boosted military spendingAuthor: Natalya Andreeva

13:05 2025-05-23 UTC+2

2128

- Technical analysis / Video analytics

Forex forecast 23/05/2025: EUR/USD, GBP/USD, SP500, Gold, and Bitcoin

Technical analysis of EUR/USD, GBP/USD, SP500, Gold, and BitcoinAuthor: Sebastian Seliga

10:51 2025-05-23 UTC+2

4603

- Donald Trump threatens EU with 50% tariffs on imports

Author: Marek Petkovich

14:59 2025-05-23 UTC+2

2413

- Fundamental analysis

Market Chaos to Continue (There is a likelihood of continued local declines in #USDX and gold prices)

Markets continue to act blindly amid the chaotic actions of Donald Trump, who is trying to pull the U.S. out of a deep, all-encompassing crisis like Baron Munchausen pulling himself out of a swamp by his own hairAuthor: Pati Gani

10:19 2025-05-23 UTC+2

2413

- Bulls launch a new offensive—the target is near

Author: Samir Klishi

20:09 2025-05-23 UTC+2

2338

- Technical analysis

Trading Signals for BITCOIN for May 23-27, 2025: sell below $108,700 (200 EMA - 21 SMA)

Our trading plan is to sell BTC below 108,700, or if it returns to $111,500, it will be seen as an opportunity to sell.Author: Dimitrios Zappas

18:16 2025-05-23 UTC+2

2278

- Technical analysis

Trading Signals for GOLD for May 23-27, 2025: sell below $3,360 (7/8 Murray - 21 SMA)

On the other hand, if gold consolidates above 3,370, the outlook could remain positive, and we could expect it to rise and reach 8/8 of the Murray level at 3,437.Author: Dimitrios Zappas

18:14 2025-05-23 UTC+2

2278

- The USD/JPY pair is in a zone of heightened price turbulence. Today's inflation report from Japan has only intensified investor interest in the yen.

Author: Irina Manzenko

13:52 2025-05-23 UTC+2

2263

- The precious metal has recovered after last week's sell-off driven by concerns over U.S. fiscal policy.

Author: Marek Petkovich

17:31 2025-05-23 UTC+2

2218

- Investors are increasingly sensing cracks in the foundation beneath them. This week's approval of a large-scale fiscal package by the Trump administration with promises of tax cuts and boosted military spending

Author: Natalya Andreeva

13:05 2025-05-23 UTC+2

2128