See also

29.04.2025 06:10 PM

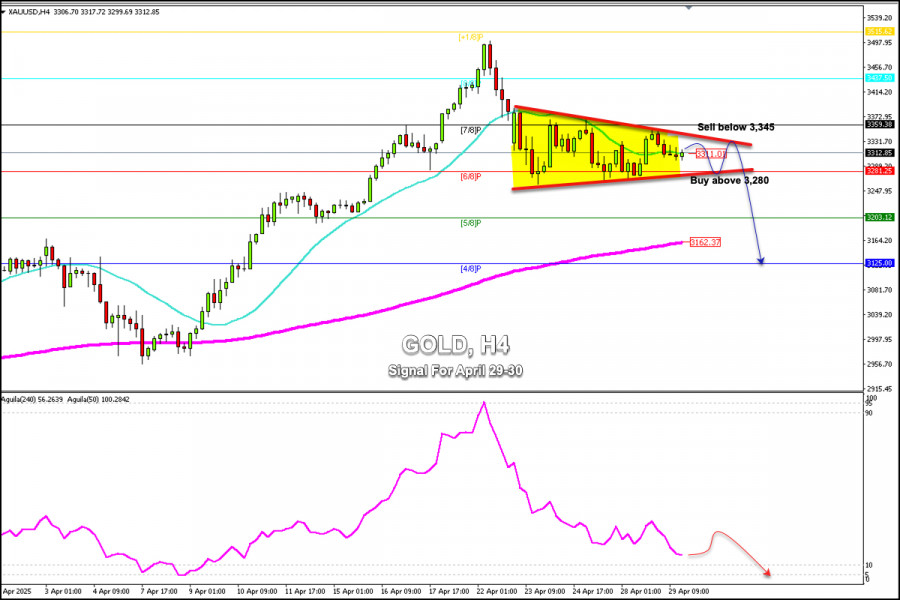

29.04.2025 06:10 PMEarly in the American session, gold is trading around the 3,310 level, where it is located at the 21SMA and within a symmetrical triangle pattern formed on April 23. Consolidation is likely in the coming days until we wait for a significant announcement.

Regarding this news, the US president will announce the auto tariffs. The rumor in the markets is that Trump will ease the auto tariffs, which would reduce demand for gold. This, in turn, could mean a drop in the gold price, and we could expect it to reach the psychological level of $3,000.

The H4 chart shows that gold is preparing for a strong move. If it breaks below 3,281, the outlook could be bearish, or it could fall towards the 200 EMA located at 3,162 and eventually reach 4/8 of the Murray around 3,125.

Conversely, if gold breaks the symmetrical triangle trend channel and consolidates above 3,359, we could expect it to reach the psychological level of 3,500 and could even reach +1/8 of the Murray at 3,515.

The Eagle indicator is showing an oversold signal, but there is still a chance of further declines, so any technical rebound will be seen as a signal to sell.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.