#AA (Alcoa Inc). Exchange rate and online charts.

Currency converter

09 May 2025 22:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

Alcoa Inc. (Alcoa), incorporated in 1888, is engaged in the production and management of primary aluminum, fabricated aluminum, and alumina combined, through its participation in technology, mining, refining, smelting, fabricating, and recycling. Alcoa’s products are used worldwide in aircraft, automobiles, commercial transportation, packaging, building and construction, oil and gas, defense, consumer electronics, and industrial applications. Alcoa is a global company operating in 31 countries. Alcoa’s operations consist of four worldwide reportable segments: Alumina, Primary Metals, Flat-Rolled Products, and Engineered Products and Solutions. On March 9, 2011, Alcoa completed an acquisition of the aerospace fastener business of TransDigm Group Inc.

Alumina

The segment represents a portion of Alcoa’s upstream operations and consists of the Company’s worldwide refinery system, including the mining of bauxite, which is then refined into alumina. Alumina is mainly sold directly to internal and external smelter customers worldwide or is sold to customers who process it into industrial chemical products. A portion of the segment’s third-party sales are completed through the use of agents, alumina traders, and distributors. Slightly more than half of Alcoa’s alumina production is sold under supply contracts to third parties worldwide, while the remainder is used internally by the Primary Metals segment.

Primary Metals

The segment represents a portion of Alcoa’s upstream operations and consists of the Company’s worldwide smelter system. Primary Metals receives alumina, mostly from the Alumina segment, and produces primary aluminum used by Alcoa’s fabricating businesses, as well as sold to external customers, aluminum traders, and commodity markets. Results from the sale of aluminum powder, scrap, and excess power are also included in this segment, as well as the results of aluminum derivative contracts and buy/resell activity. The sale of primary aluminum represents more than 90% of this segment’s third-party sales. At December 31, 2011, Alcoa had 644 kilo-metric tons of idle capacity on a base capacity of 4,518 kilo-metric tons.

Flat-Rolled Products

The segment represents Alcoa’s midstream operations, whose principal business is the production and sale of aluminum plate and sheet. A small portion of this segment’s operations relate to foil produced at one plant in Brazil. The segment includes rigid container sheet (RCS), which is sold directly to customers in the packaging and consumer market and is used to produce aluminum beverage cans. The segment also includes sheet and plate used in the aerospace, automotive, commercial transportation, and building and construction markets (mainly used in the production of machinery and equipment and consumer durables), which is sold directly to customers and through distributors. Approximately one-half of the third-party sales in this segment consist of RCS, while the other one-half of third-party sales are derived from sheet and plate and foil used in industrial markets.

Engineered Products and Solutions

The segment represents Alcoa’s downstream operations and includes titanium, aluminum, and super alloy investment castings; forgings and fasteners; aluminum wheels; integrated aluminum structural systems; and architectural extrusions used in the aerospace, automotive, building and construction, commercial transportation, and power generation markets. The products are sold directly to customers and through distributors. Additionally, hard alloy extrusions products, which are also sold directly to customers and through distributors, serve the aerospace, automotive, commercial transportation, and industrial products markets. Engineered Products and Solutions business is a global designer, producer, and supplier of engineered aircraft components, with three locations (one in the state of California and two in the United Kingdom). Specifically, this business provides a variety of nickel alloy specialty engine fasteners, airframe bolts, and slotted entry bearings.

See Also

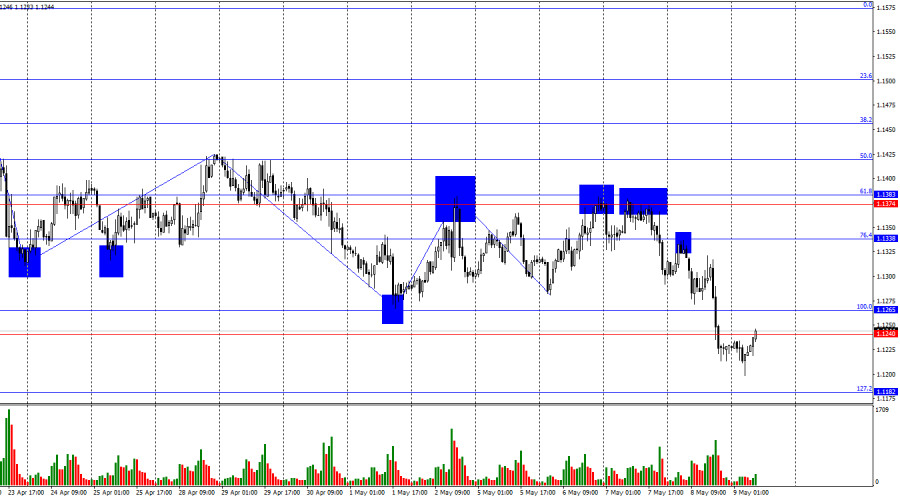

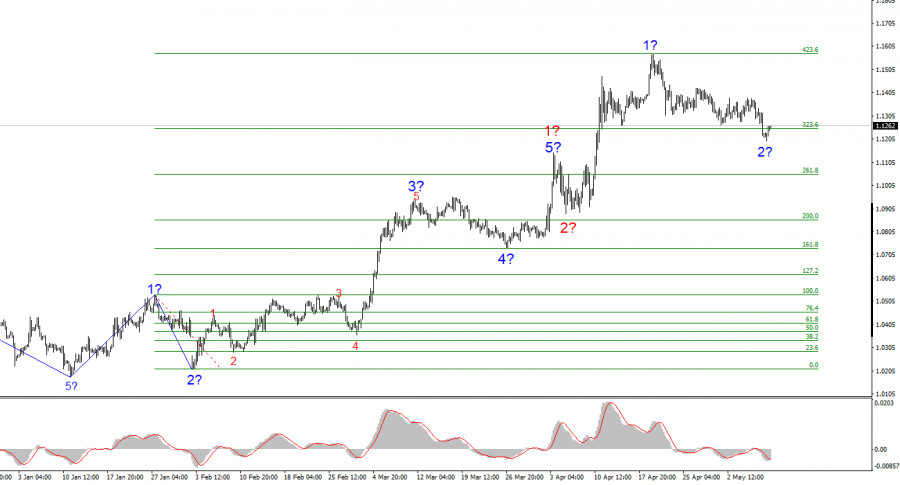

- Bears reacted to the Fed meeting results only a day later.

Author: Samir Klishi

11:24 2025-05-09 UTC+2

1588

Technical analysisTrading Signals for GOLD for May 9-12, 2025: sell below $3,361 (21 SMA - 7/8 Murray)

On the other hand, if the bearish force prevails, gold is expected to continue falling and could again test the 6/8 Murray level, which could serve as a good point to resume buying.Author: Dimitrios Zappas

15:01 2025-05-09 UTC+2

1543

The EUR/USD rate rose by 40 basis points on FridayAuthor: Chin Zhao

19:19 2025-05-09 UTC+2

1453

- Technical analysis / Video analytics

Forex forecast 09/05/2025: EUR/USD, USD/JPY, Gold, Ethereum and Bitcoin

Technical analysis of EUR/USD, USD/JPY, Gold, Ethereum and BitcoinAuthor: Sebastian Seliga

09:53 2025-05-09 UTC+2

1408

The U.S. Dollar Index consolidates in bullish territory.Author: Irina Yanina

11:31 2025-05-09 UTC+2

1333

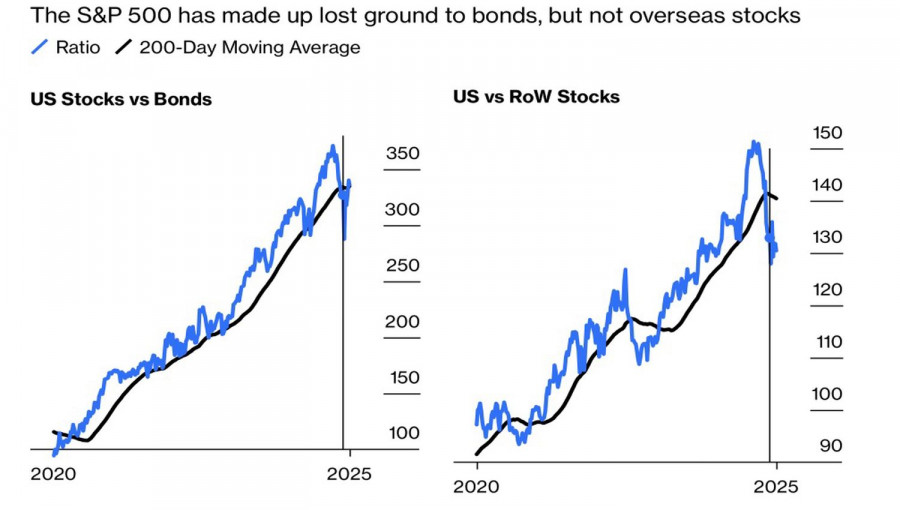

Investors should focus on the White House's actions, not its wordsAuthor: Marek Petkovich

11:10 2025-05-09 UTC+2

1303

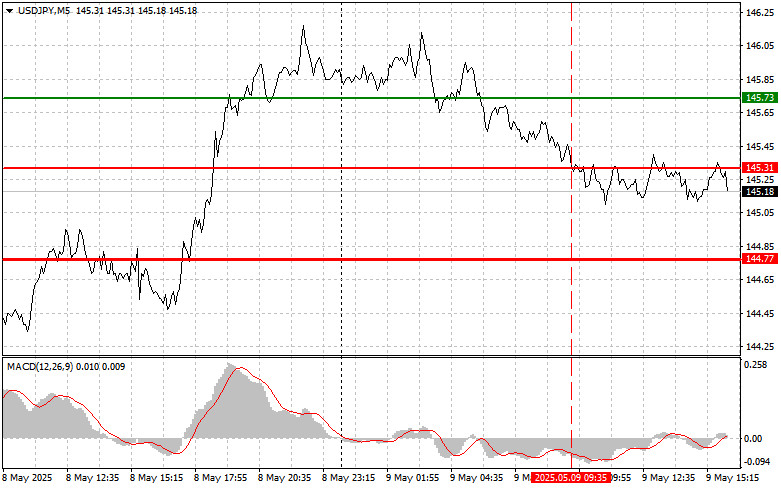

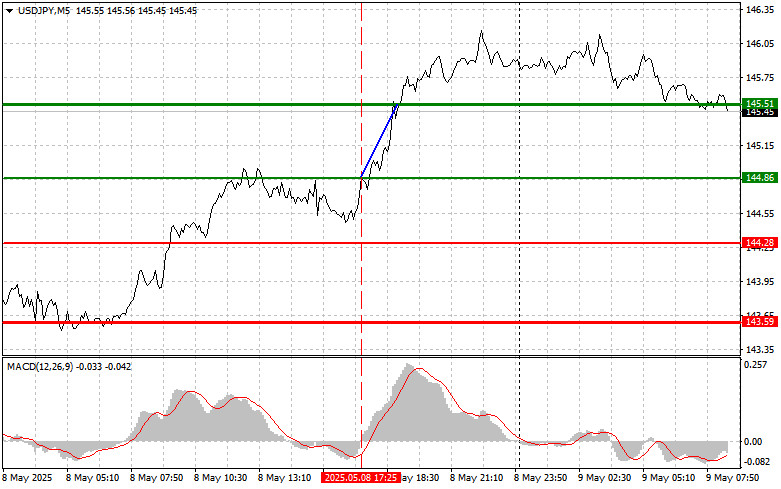

- USD/JPY: Simple Trading Tips for Beginner Traders on May 9th (U.S. Session)

Author: Jakub Novak

19:13 2025-05-09 UTC+2

1273

Geopolitical risks revive demand for safe-haven assetsAuthor: Irina Yanina

18:52 2025-05-09 UTC+2

1273

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on May 9. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on May 9. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:44 2025-05-09 UTC+2

1258

- Bears reacted to the Fed meeting results only a day later.

Author: Samir Klishi

11:24 2025-05-09 UTC+2

1588

- Technical analysis

Trading Signals for GOLD for May 9-12, 2025: sell below $3,361 (21 SMA - 7/8 Murray)

On the other hand, if the bearish force prevails, gold is expected to continue falling and could again test the 6/8 Murray level, which could serve as a good point to resume buying.Author: Dimitrios Zappas

15:01 2025-05-09 UTC+2

1543

- The EUR/USD rate rose by 40 basis points on Friday

Author: Chin Zhao

19:19 2025-05-09 UTC+2

1453

- Technical analysis / Video analytics

Forex forecast 09/05/2025: EUR/USD, USD/JPY, Gold, Ethereum and Bitcoin

Technical analysis of EUR/USD, USD/JPY, Gold, Ethereum and BitcoinAuthor: Sebastian Seliga

09:53 2025-05-09 UTC+2

1408

- The U.S. Dollar Index consolidates in bullish territory.

Author: Irina Yanina

11:31 2025-05-09 UTC+2

1333

- Investors should focus on the White House's actions, not its words

Author: Marek Petkovich

11:10 2025-05-09 UTC+2

1303

- USD/JPY: Simple Trading Tips for Beginner Traders on May 9th (U.S. Session)

Author: Jakub Novak

19:13 2025-05-09 UTC+2

1273

- Geopolitical risks revive demand for safe-haven assets

Author: Irina Yanina

18:52 2025-05-09 UTC+2

1273

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on May 9. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on May 9. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:44 2025-05-09 UTC+2

1258