Veja também

30.04.2025 12:43 AM

30.04.2025 12:43 AMAlthough the past week was completely uninformative regarding fundamental indicators, it allowed adjustments to forecasts on economic growth, inflation, and the Reserve Bank of New Zealand's policy strategy based on new data.

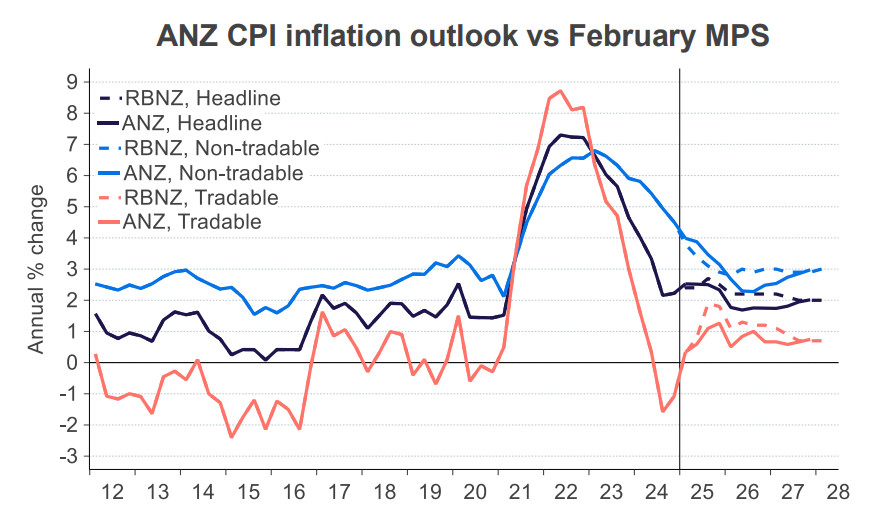

ANZ Bank revised its inflation forecast. Earlier, it had downgraded its projections for GDP growth, the labor market, and housing prices—each of which alone would be sufficient to expect a more aggressive rate-cutting stance from the RBNZ. On inflation, ANZ maintains a firm position that inflation is virtually under control—despite it having risen in Q1 from 2.2% to 2.5% year-over-year, the highest level since June last year. While claiming that inflation is decelerating, ANZ analysts offer numerous well-founded arguments, which we'll take at face value for now.

According to ANZ, overall inflation will slow to about 1.7% by mid-2026 and rise to 2% by 2027. While such long-range forecasting may seem somewhat naive in today's uncertain environment, the more important takeaway is that projections for GDP, labor, and inflation allow us to forecast the RBNZ's interest rate decisions. Such projections, in turn, shape future yields—and, therefore, the exchange rate.

The trend suggests a faster pace of rate cuts here. Currently, markets expect rates to be lowered to 2.5%, but some are already suggesting the terminal rate may go even lower—to around 2%—especially if the threat of a recession resurfaces alongside disinflation.

BNZ Bank, on the other hand, holds an entirely different view and warns that "inflation is neither dead nor buried. It is already trending upward in annual terms, and early signs indicate inflation expectations—especially among households—are rising (from 4.2% to 4.7%)." The bank cautions the RBNZ against cutting rates too quickly.

All this points to a backdrop of confusion, volatility, and uncertainty. In such a tense environment, it is better to rely on actual capital flows, yields, and futures market positioning, as these reflect the real intentions of major players.

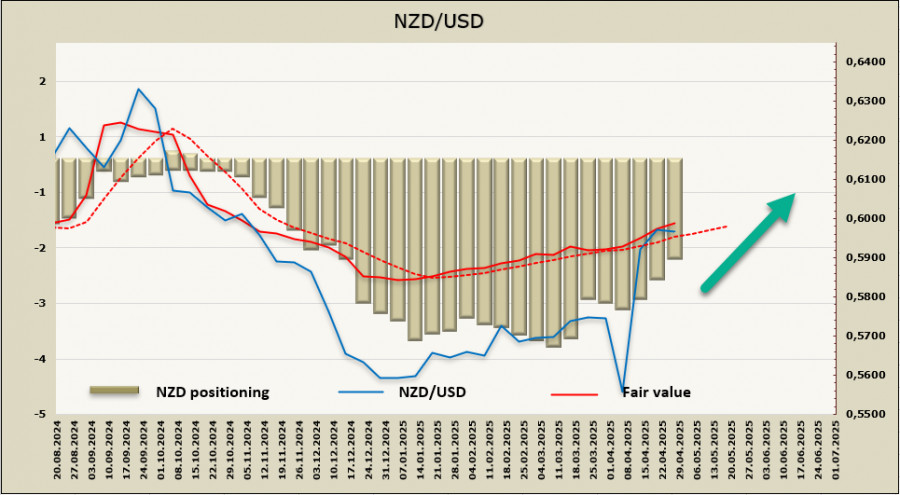

The net short position on NZD narrowed by $346 million last week, bringing the total to—$1.6 billion, the smallest short position since early December last year. The Kiwi remains in negative territory—where it fell immediately after Trump's election as U.S. president—but since February, the trend has shifted in favor of the New Zealand dollar. Its fair value remains above the long-term average, with no signs of a reversal to the downside for now.

Last week, the NZD/USD pair reached strong resistance at 0.6030 but failed to break through on the first attempt. The likelihood of a pullback has increased, with immediate support seen at 0.5896. However, if Friday's U.S. labor market report indicates economic resilience, the pair could fall further—into the 0.5815/50 range. For now, there is little justification for a full-fledged reversal to the downside; the expected decline is viewed as a correction, and a renewed rally is anticipated, with another attempt to gain a foothold above 0.6030.

If successful, there will be no strong technical resistance levels until the local high of 0.6362 (from September 30). However, political uncertainty is unlikely to support such a strong advance.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

A oposição interna a Donald Trump está ganhando força, o que pode ser uma surpresa desagradável para o ex-presidente. Esse desenvolvimento pode limitar seus esforços para remodelar o cenário econômico

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

Gráfico de Forex

Versão-Web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.